This is the third in my series of articles focused on the Modernization of the Electric Grid and a continuation of the second article focused on our vast transmission network. In the prior article, I focused on the characteristics of the network, issues of ownership, operation, and regulation, and the nature of the work associated with building and maintaining the system. This article will focus on the future of the transmission network, near and long term, and the drivers pushing for massive expansion and potentially significant changes to its operation.

As I mentioned in my first article, there are several growing drivers that will be prompting truly massive investment in the grid and likely dwarfing the already impressive array of projects under construction today. The recently passed Bipartisan Infrastructure Law (BIL) is paving the way for near-term expansion and modernization and will set the stage for even more significant future work. In that first article, I listed three major drivers of general future grid investment:

- Aging Grid Infrastructure

- Reliability and Resilience Improvement

- Lower Carbon Energy Transition

For this article, I will focus primarily on the Lower Carbon Energy Transition topic, as that has the potential to be the most significant driver by far and has major implications for the design, buildout, and operation of the transmission system. Upgrade and expansion work prompted by this driver will also typically provide benefits related to aging infrastructure replacement and to reliability and resilience. The transition to lower carbon energy has two related components happening simultaneously – electrification of additional loads like transportation and home heating and the integration of significant distributed energy resources (DERs) like wind, solar, and battery storage.

The direct impacts of electrification will be seen primarily on the medium voltage (5KV-25KV) distribution grid, as well as the low voltage secondary’s (pole top transformers and the service wires to each home). Utilities will likely have to add additional distribution circuits, and potentially upgrade substation transformers, especially when significant charging infrastructure is needed for fleets of buses, delivery trucks, or even ferries. Ultimately, enough additional load will impact the transmission grid, especially in those locations already experiencing “congestion” during times of peak load. To minimize the inevitable impact on the T&D system, it will be extremely important early in the electrification transition to establish intelligent regulation and rate policy for proper guardrails and incentives. For example, EV charging can be encouraged to, as much as possible, avoid the times of traditional system peak loads and be incented to leverage local renewable generation when available. Vehicle battery storage will also be able to support the grid during non-travel times using emerging vehicle-to-grid (V2G) technologies. This has the potential to not only minimize the load impacts of vehicle charging but can also support local renewable generation integration. School bus fleets have great potential in this regard, as do the massive numbers of personal vehicles typically parked at offices during the middle of the workday.

Still, the projected electric demand increase from EV charging is daunting. A 2018 study by researchers at University of Texas at Austin provided a rough state-by-state estimate of the increased energy for vehicle charging, breaking out the approximately 3 trillion annual miles driven in the US, and converting it to electric energy based on average EV efficiency at that time. Increased energy usage for each state varied from 10% to over 50% beyond current energy use, with the total additional energy increase of several thousand gigawatthours per day. How and when that charging occurs plays a critical role in what the actual hourly electric demand increase in any particular area will be. Also critical will be the rate of EV adoption in the near future, and whether that adoption gets ahead of appropriate rate policy to incent better charging practices. It is extremely likely there will be localized transmission and substation capacity increases needed, again especially where current grid congestion issues exist.

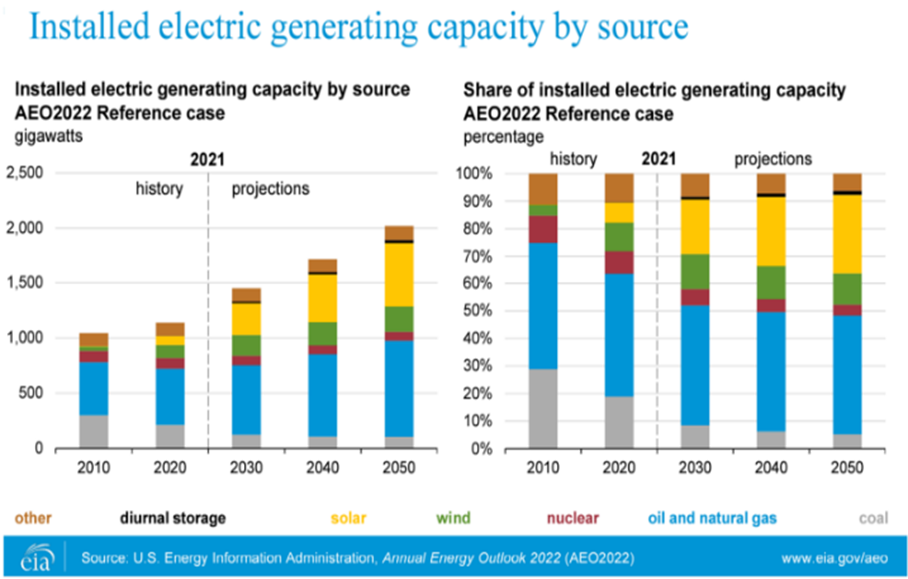

On the DER integration front, the proliferation of large, utility-scale wind and solar generation is already causing a big increase in transmission project work. This trend is set to keep accelerating over the coming decades as renewable generation, and energy storage continues to get cheaper and supply a larger chunk of the overall generation mix. Latest forecasts from the typically conservative US Energy Information Administration (EIA) indicate solar and wind capacity to increase from around 250 GW today to around 550 GW by 2030 and 800 GW by 2050. The Department of Energy (DOE) indicates a much more robust forecast, in line with aggressive grid decarbonization and energy electrification goals, of around 1,500 GW by 2035 and 2,500 GW by 2050 (along with a staggering 1,800 GW of energy storage). Of course, there are numerous technical and political forces at play in these forecasts, but even in a conservative outlook, it is very obvious that grid planners will be faced with the challenges of integrating a huge amount of intermittent renewable generation over the coming years.

That challenge is already apparent in many parts of the country, where we can see significant backlogs of interconnection requests from renewable energy developers in the local utility engineering departments. Many requests have been stuck in a holding pattern for several years as utilities struggle to complete the usually complex interconnection studies. Unfortunately, since submitting a request is fairly easy, even for large and complex interconnections, a non-trivial number of requests are submitted with minimal likelihood of ever getting built. This only adds to the problem. FERC has recently begun to intervene, issuing a notice of proposed rulemaking (NOPR) to streamline the interconnection process, adding requirements and penalties for transmission providers to complete studies on time, and more stringent requirements for developers to prove they can actually build what is proposed.

Transmission work is typically needed for any large (greater than 20 MW) generator in order to interconnect that source to the grid. Smaller generators can usually connect to the local distribution system. Even when the generator is installed next to an existing transmission line, a small substation with equipment like breakers, transformers, and buswork is needed to rearrange the existing grid in that area, including protection schemes that are designed to de-energize and re-energize the lines for any potential disturbance. The existing transmission line(s) must also still be able to operate when the generating plant needs to be isolated for maintenance work or repairs. The simplest of these interconnections still requires adequate study by grid planners, project planning, and detailed engineering design, construction, and final commissioning work. Ramping up the amount of generation on the system in coming years will take some streamlining of this process, along with an increase in engineering and construction resources in the very near future.

Some states and regions are leaning into this challenge aggressively, attempting to not only react rapidly to proposed generator interconnections but to also come up with a more proactive, holistic, and inclusive plan for transmission grid expansion and upgrades to enable and encourage renewable generation in optimal locations. The State of New York, for example, conducted an expansive “Power Grid Study” in 2020 in coordination with state regulatory and other agencies and all six major electric utilities. This study identified near-term priority transmission projects (to support currently approved generator interconnections) and longer-term projects and corridors to help facilitate pending or future renewables development. This 700+ page report identified and recommended expedited approval for 52 near-term projects with a cost of $4.2 billion. This does not include several other planned multi-billion dollar transmission projects like the 339-mile Champlain Hudson Power Express and the 175-mile line included with the Clean Path NY project. In addition, plans are also underway to upgrade facilities in Long Island to access approximately 9,000 MW of offshore wind, slated for installation during the next 5-15 years. All of this planned work, just in the State of New York and just within the next decade or so, hopefully, illustrates the incredible magnitude of effort that will be needed across the country in these first steps of the transition to a lower carbon future.

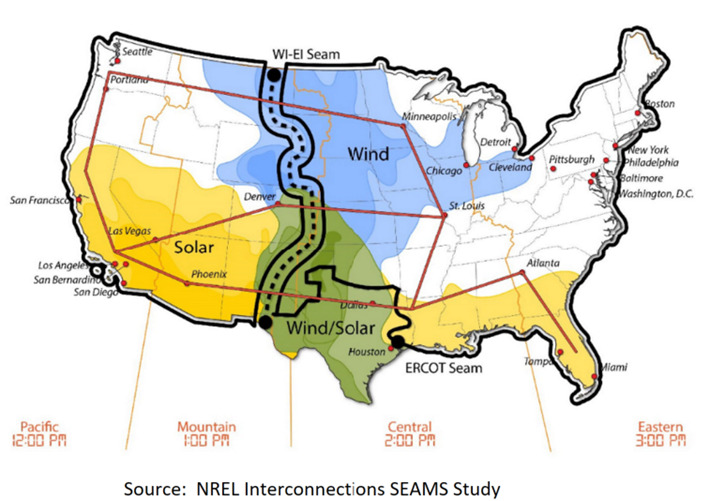

In addition to detailed studies like New York’s, there are also more general studies and proposals on the national scale, broader in scope and longer in term, that include ideas to enable much larger power flows over greater distances. This would allow for a more flexible and efficient balancing of generation and load on a grid with significant penetrations of intermittent renewables. In this way, areas of the country that have a natural abundance of hydro, solar, and/or wind resources can produce far more energy without having to be curtailed as often. There are a variety of ideas for a national HVDC network, like those from the National Renewable Energy Lab (NREL) and the Energy Systems Integration Group (ESIG), which would create high-capacity ties between the separated Eastern, Western, ERCOT, and Quebec Interconnections. These proposals would also leverage expanded off-shore wind generation on both coasts and include significant expansion of the existing AC transmission networks within each interconnection. High-level estimates for a “macrogrid” like this exceed multiple trillions of dollars over a few decades. Daunting investments like this will require new ways of justifying and distributing costs across larger portions of the country, as well as changes to the traditional energy markets and regional operations of the grid, with much more coordination needed between the RTOs and ISOs and across the separate interconnections.

There are plenty of other headwinds for grand initiatives like this, not least of which is the difficulty we have today with getting new transmission lines built, especially when the proposed lines cross through regions that do not observe any direct benefit to the lines. Recent costly project cancellations like Northern Pass in New Hampshire and New England Clean Energy Connect in Maine highlight the risk involved today for companies that pursue ambitious projects like this. Both projects would have delivered 24/7 dispatchable, renewable hydro power from Quebec into the New England grid, helping the states in the region achieve their own renewable energy targets. Local opposition to portions of the proposed lines were enough to prevent the projects from proceeding, causing painful expense write-offs of a few hundred million dollars for the companies involved.

Still, it appears obvious that there is significant work ahead for the nation’s vast transmission grid. The Bipartisan Infrastructure Law, with $65 billion devoted to the grid, is an important step and will pave the way for further expansion and modernization. There are massive opportunities for industries that are poised to support this effort, as well as exciting, well-paying jobs for new scientists, engineers, construction workers, and high voltage line workers. And I just can’t repeat this enough – What an exciting time to be in this industry!

To learn more about modernization of the electric grid check out the rest of this blog series below!